FINANCIAL performance

×

Home Foreword

Stories Cultivating a Brighter Future: How CIP’s Strategic Vision Transformed People’s Lives Biodiversity story Mobilizing genetic diversity to enrich agroecologies and livelihoods Crop improvement story Developing and delivering superior varieties that meet changing farmer and consumer demands Regenerative improvement story Improving farmers’ productivity and income, while building resilience in agricultural systems for sustainable and equitable growth Urban Food Systems story ADAPTING AGRICULTURAL AND FOOD INNOVATIONS TO IMPROVE URBAN DIETS AND LIVELIHOODS

>

FINANCIAL performance

Revenue

Total revenue in 2023 amounted to USD 49.9 million, against a total expenditure of USD 49.2 million, resulting in a surplus of USD 0.7 million.

Reserves

On December 31, 2023, CIP reserves were USD 13.2 million (equal to 86 days of expenditure—within CGIAR norms), compared to USD 12.5 million (84 days) on December 31, 2022.

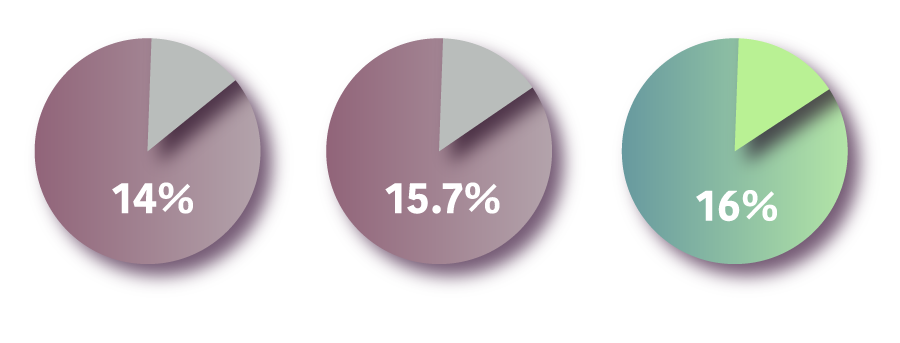

Overhead Rate

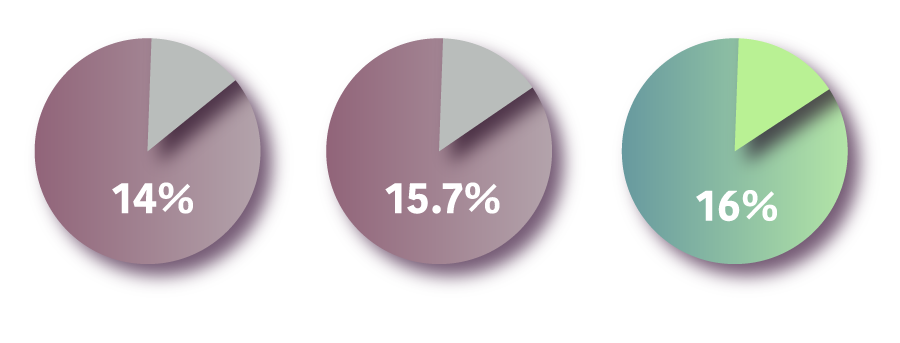

The indirect cost ratio of the Center was 16% for 2023. The ratio is calculated in line with the CGIAR Cost Principles and Indirect Cost Guidelines (issued in April 2019) and expresses the relationship between direct and indirect costs.

CIP’s financial indicators reflect the Center’s ongoing efforts to strengthen its financial health. The Board remains confident that, based on sound financial and programmatic management, the institution is well-positioned to fulfill its mission. However, no institution is immune to financial or operational risks. To mitigate these risks, the Board’s Audit and Risk Committee oversees CIP’s risk management policies and plans. More broadly, the Board supervises Center operations in the interest of funders and stakeholders.

Revenue

Total revenue in 2023 amounted to USD 49.9 million, against a total expenditure of USD 49.2 million, resulting in a surplus of USD 0.7 million.

Reserves

On December 31, 2023, CIP reserves were USD 13.2 million (equal to 86 days of expenditure—within CGIAR norms), compared to USD 12.5 million (84 days) on December 31, 2022.

Overhead Rate

The indirect cost ratio of the Center was 16% for 2023. The ratio is calculated in line with the CGIAR Cost Principles and Indirect Cost Guidelines (issued in April 2019) and expresses the relationship between direct and indirect costs.

CIP’s financial indicators reflect the Center’s ongoing efforts to strengthen its financial health. The Board remains confident that, based on sound financial and programmatic management, the institution is well-positioned to fulfill its mission. However, no institution is immune to financial or operational risks. To mitigate these risks, the Board’s Audit and Risk Committee oversees CIP’s risk management policies and plans. More broadly, the Board supervises Center operations in the interest of funders and stakeholders.